How Mayfair Legal Funding Works

Legal funding is essential for giving people who are involved in legal proceedings or personal injury claims financial backing. It aids in making sure that everyone is entitled to justice and lessens the financial strain. Mayfair, a provider of legal funding, provides a range of funding options intended to satisfy the specific demands of plaintiffs.

As you read on, we will discuss the many legal funding options offered by Mayfair, their advantages, and how to make the most beneficial decision.

You can obtain the funds you’re seeking for regular expenditures with the help of legal funding from Mayfair.

Complete the form on our page free of charge. In a matter of hours, if approved, you could receive up to $1 million in your bank! For further information or to discover how we may assist you, contact us at (866) 377-8196.

Vehicle Accidents

Car Accidents

Car accident pre-settlement loans, often referred to as settlement loans or accident cash advances, are available from Mayfair Legal Funding for individuals who were involved in auto accidents and are awaiting a payout. Your physical state, psychological well-being, and financial stability can be gravely impacted by these car accidents. The cost of healthcare bills, car repairs, and other costs can make recovering difficult.

Legal funding for car accidents helps the victims pay for immediate expenses by bridging the financial gap between the accident and their eventual settlement. By accessing the money they need to settle medical bills, auto repairs, and other daily needs, these loans play a critical part in aiding victims’ recovery and moving on with their lives.

Car accident loans examine your case based on the prospective settlement amount as opposed to your credit history or repayment capacity, in contrast to conventional loans. Typically, the loan amount represents a portion of the expected payout. You must have legal counsel and a compelling claim to qualify, as judged by underwriters and attorneys who weigh the merits and prospects of a successful settlement.

Car accident loans from Mayfair Legal Funding come with simple interest rates, swift funding, and top-notch customer service. Our application process is simple, and we place an emphasis on transparency and unambiguous terms. Mayfair is committed to helping you with your car accident financial needs, whether you want to go with a car accident loan or investigate other possibilities like personal loans or medical payment coverage.

You can apply through our website’s secure application form or call our consultants at (866) 377-8196 to get started. Don’t allow a car accident to trap you in debt. Mayfair Legal Funding is here to help you during your recovery journey.

Bicycle Accident

Bicycle accident victims can get lawsuit loans from Mayfair Legal Funding to help them out while their cases are being litigated. The incidence of bicycle accidents has increased along with the popularity of bicycling, leaving the victims with catastrophic injuries and mounting expenses. Mayfair offers financial support to lessen the initial burdens that victims of bicycle accidents must bear.

Bicycle accident lawsuit loans from Mayfair are non-recourse loans also called bicycle accident legal funding or pre-settlement money. This implies that repayment is conditional on the lawsuit’s success, and borrowers are not bound in paying back the loan if their case is unsuccessful. Mayfair prevents victims from accepting less money in compensation owing to financial pressure by giving them swift funds to meet medical costs and fix their bikes.

Depending on the facts of each case, Mayfair determines the loan extent, which can range from $500 to $1 million or more for cases with greater valuations. Before obtaining a lawsuit loan, borrowers are needed to have legal representation so as to improve their borrowing capacity and guarantee their legal protection.

Mayfair Legal Funding aids bicycle accident victims in pursuing just compensation while resolving immediate financial issues by offering vital financial support throughout the legal procedure. Victims are better equipped to handle their legal route when they comprehend the lending process and make knowledgeable choices. Individuals can start the process by calling Mayfair at (866) 377-8196 or going to our Apply Now page to set up a free consultation.

Bus Accidents

People with legitimate bus accident claims can get lawsuit loans from Mayfair Legal Funding wherever in the country. Due to medical expenses, income loss, and legal fees, bus accidents can cause serious financial hardship. Mayfair adheres to state and federal lending regulations and offers loans from $500 to $1 million. Further, you are not obligated to shell out the loan if your lawsuit is unsuccessful.

Pre-settlement funding, another name for lawsuit loans for bus accidents, gives plaintiffs money in advance while they wait for their cases to be resolved. Mayfair assesses the validity of your claim and the probability of a successful settlement or verdict. They provide an upfront payment in exchange for the prospective future payout based on this evaluation.

You must’ve been involved in a bus accident case to be eligible for a lawsuit loan, and Mayfair will evaluate the merits of your claim and the likely value of any settlement or award. The approval process is unaffected by work status or credit rating. To support your application, you must submit relevant documents including medical records, police reports, and witness statements. In contrast to traditional loans, Mayfair offers immediate access to money, with approval often taking as little as 48 hours.

It is essential to have legal representation when managing bus accident cash advances since they may give you legal counsel, deal with Mayfair on your behalf, and attempt to increase the payout. Mayfair accepts applications for free and may be reached via phone or through our website.

Mayfair Legal Funding provides aid if you are struggling financially as the outcome of a bus accident and need financial relief throughout the legal process.

Motorcycle Accidents

Motorcycle accident victims who are suffering from severe injuries and heavy financial obligations can get vital support from Mayfair Legal Funding. To obtain payment for hospital bills, income loss, and other expenses, it is frequently necessary to file a lawsuit against the party triggering the accident. The protracted legal process and mounting costs associated with waiting for a settlement, however, can be disheartening. Mayfair’s legal funding for motorcycle accidents can be of critical assistance in such cases.

The motorcycle accident lawsuit loans from Mayfair sometimes referred to as settlement loans or legal funding, offer financial assistance to people who are suing for motorbike accidents. These litigation loans are not based on credit scores or employment status like traditional loans are. Instead, collateral is the anticipated settlement or reward from the lawsuit. Victims of motorcycle accidents must apply to Mayfair, which evaluates the claim’s merits and chances of victory, so as to get legal support. Once authorized, victims can get part of the anticipated payouts upfront in less than 48 hours! The victim is usually not required to repay the debt if the case is unsuccessful.

Mayfair Legal Funding might help if you are a victim of a motorbike accident and are struggling financially while pursuing compensation. Our litigation loans provide immediate financial support, level the playing field with insurance companies, and pay for many types of expenses. Given your financial worries, avoid delaying obtaining full compensation for your injuries. Get a free loan consultation from Mayfair Legal Funding at (866) 377-8196 to get motorcycle accident funding right away.

Truck Accidents

In the wake of significant commercial vehicle accidents, Mayfair Legal Funding provides loans for truck accident lawsuits to assist those who have suffered major injuries and are now facing rising financial difficulties. After being hurt in a truck accident, plaintiffs frequently struggle to pay for medical bills, lost income, and other expenditures while they wait for a payout. Truck accident legal funding from Mayfair might offer much-needed financial assistance during this trying time.

Depending on the particulars of their cases, clients may employ Mayfair to receive pre-settlement money ranging from $500 to $1,000,000. Traumatic brain injuries, spinal cord injuries, and other common disabilities sustained in truck accidents could hinder victims from working or taking care of themselves. The size of commercial trucks plays a big part in why trucking accidents have such high mortality and injury rates.

The truck accident lawsuit loans from Mayfair sometimes referred to as pre-settlement or legal financing, provide up-front cash advances that are guaranteed by the anticipated settlement or verdict of the legal case. Unlike regular loans, these non-recourse loans don’t require collateral or credit checks. For the purpose of approving a loan, Mayfair assesses the merits of the claim and the likelihood of a favorable settlement or verdict. Borrowers are normally not required to return the loan if the lawsuit is unsuccessful; repayment is only necessary when the case is settled.

Applicants must have a valid truck accident lawsuit as well as legal counsel for them to be qualified for a loan from Mayfair for a truck accident case. Mayfair assists people in seeking justice by providing quick access to money with no up-front fees or recurring commitments. Determining if a lawsuit loan is an ideal option for you is for you to do some research, consider your alternatives, and speak with an attorney. Mayfair can be reached by phone at (866) 377-8196 or online, and arranging an appointment is completely free of charge and is not considered a contract.

Personal Injury

About Personal Injury

For people with personal injury claims, Mayfair Legal Funding provides personal injury loans as a financial alternative. These non-recourse loans provide money to cover costs during the protracted legal procedure; repayment is only necessary if the case is won. The personal injury loans from Mayfair provide numerous advantages, such as a simple application procedure, non-recourse finance, and flexible repayment alternatives.

Personal injury loans can be utilized to satisfy various costs, including rent or mortgage payments, regular expenditures like groceries and utilities, medical care, child care costs, and educational costs like student loans, car loans, and credit card debt. The money can be spent on whatever the borrower chooses and will serve as support money for the litigation.

Mayfair guarantees a quick application and approval procedure, usually taking just a few days or 48 hours because they are aware of the urgency of financial necessities in personal injury claims. Mayfair offers personal injury loans without upfront costs or recurring payments, unlike other lenders.

Nursing Home Negligence

Mayfair can give you a loan secured by your prospective settlement if you have a claim and anticipate you have a strong chance of winning. This money can be utilized right away to pay for living expenses, debts, medical expenditures, and other obligations. Simply complete the free application on our Apply Now page, and if approved, you may obtain up to $1 million deposited into your savings account within 48 hours.

The goal of Mayfair’s nursing home negligence lawsuit funding is to level the playing field for accident victims by giving them the resources they need to hire skilled lawyers, gather evidence, and deal with challenging legal processes. Victims can seek justice and compensation to pay medical expenses, suffering, and other damages by pursuing those liable and holding them accountable.

Our funding carries no risk and has no bearing on your personal financial records. We don’t rely on credit checks, impose ongoing monthly fees, or demand payment in the event that your case is unsuccessful. We solely want to provide you with the financial support you require as you pursue your legal case.

You can also discover useful information about assisted living, nursing homes, the cost of care, ethical and legal concerns, common myths, and the differences between them. By doing this, we offer clients and their families the details necessary to arrive at educated choices about caring for the well-being of those they love.

Construction Accidents

Mayfair Legal Funding offers financial support to claimants in litigation involving construction accidents. These mishaps frequently leave victims and their families in financial trouble due to severe injuries, high medical costs, and missed wages. Mayfair is aware of the difficulties these people encounter and provides litigation loans to lessen their financial load throughout the judicial process.

Mayfair offers funding ranging from $500 to $1,000,000, given the specifics of the suit. If the lawsuit is successful, the loan sum is paid back from the eventual settlement. Plaintiffs who qualify for this form of funding, often referred to as pre-settlement funding, have immediate access to money to address pressing costs associated with their lawsuit.

Construction-related mishaps that cause major injuries or fatalities frequently include falls, equipment malfunctions, and electrocutions. Legal action is essential to establish responsibility and demand restitution. To make a compelling argument, Mayfair stresses the significance of comprehending the factors that lead to these disasters.

Mayfair also emphasizes personal injury litigation against negligent third parties as well as the availability of workers’ compensation payments in addition to claims involving construction accidents. These options offer further opportunities for financial settlement.

There are no criteria for a credit check or job verification; eligibility is determined by the merits of each case. To begin the application process, interested parties can contact Mayfair through our phone number or online form.

Medical Malpractice

Pre-settlement funding is one of our specialties at Mayfair Legal Funding, which we offer to clients in medical malpractice cases. As you wait for your case to be settled, we want to lessen any financial strain you might be under. With the help of our lawsuit loans, you can obtain a percentage of your potential compensation up-front and use it to pay for urgent needs as your legal case moves further.

Our procedure is quick and easy. Upon completing your application, our team assesses the specifics of your case and collaborates with your lawyer to examine the viability of your claim. Mayfair’s legal funding option is non-recourse, in contrast with conventional loans, so you only pay us back if you prevail in court. There are no additional monthly payments or up-front costs to be concerned about.

With Mayfair Legal Funding, we’ll take care of the financial aspects so you can concentrate on getting better and maximizing the result of your lawsuit. Our dedication to transparency, integrity, and professionalism distinguishes us as among the pioneers in the field.

Mayfair Legal Funding is available to assist you if you are involved in a medical malpractice case and require emergency financial support. To learn more about our litigation loan alternatives and to begin the application procedure, get in touch with us right now.

Dog Bite

Dog bite injuries are usually accompanied by medical costs, reduced income, and other financial obligations. They can be physically and emotionally distressing. Pre-settlement funding can be obtained from Mayfair Legal Funding to help you recover control over your financial situation because we are aware of the difficulties you may be experiencing at this trying time.

You can quickly and simply get a dog bite lawsuit loan from Mayfair Legal Funding. Our streamlined application procedure guarantees a hassle-free application process, and financing decisions are made quickly. Mayfair Legal Funding offers non-recourse litigation funding as opposed to conventional loans, so you only have to pay it back if you win the lawsuit.

To cater to your individual requirements, Mayfair Legal Funding offers several funding solutions. We have you covered whether you need a small loan to pay emergency costs or a larger sum to support you during the course of your case.

Mayfair Legal Funding is available to help you if you’re seeking funding for a dog bite case. Visit our website right now to find out more about our loans for dog bite lawsuits and to start the process of obtaining financial relief during this difficult period.

Pedestrian Accidents

Accidents involving pedestrians can cause severe injuries that necessitate high medical costs, income loss, and psychological distress. We offer loans for pedestrian accident lawsuits since the team is aware of the difficulties you can have while you are awaiting a settlement. Based on the merits of your case, we offer fast cash with a straightforward application and speedy approval procedure. Our adaptable funding choices cover living expenditures, legal fees, and health care costs. You have to pay back the loan only if you win your case, and it also boasts low-interest rates and a non-recourse structure. We highly value transparency and client satisfaction, providing support and responding to any inquiries you might have.

Product Liability

Pre-settlement funds for product liability claims are available via Mayfair Legal Funding, giving victims of dangerous consumer goods financial relief. The lawful duty of manufacturers, sellers, suppliers, and retailers to guarantee the reliability and quality of their goods is referred to as product liability. Victims who suffer suffering or injury as a consequence of a defective product may pursue compensation through challenging legal processes. Mayfair Legal Funding is aware of the difficulties plaintiffs must overcome and offers them the tools they need to seek redress. Our assistance reduces financial burdens, enabling people to obtain competent legal counsel, pay for living and medical expenses, and provide an even playing field with well-funded adversaries.

Slip and Fall

Are you struggling financially as a result of a slip and fall? Let Mayfair Legal Funding be of assistance. Mayfair’s slip-and-fall legal funding protects your finances from risk because, unlike ordinary loans, it only needs to be repaid if your claim is successful. Your personal assets are typically not at risk thanks to our non-recourse financing, which reduces the burden on you. We provide a quick application and approval process because we are aware of the urgency of slip-and-fall instances. Avoid letting a slip-and-fall accident ruin your finances. You have the help of Mayfair Legal Funding while you proceed through the legal procedure.

Spinal Cord Injuries

For people involved with spinal cord injury (SCI) cases, Mayfair Legal Funding specializes in offering lawsuit loans. Car crashes and severe falls are the most common causes of SCI in the US. We offer hope to those struggling and are mindful of the physical, psychological, and financial hardships linked to these cases. Similar to other financing companies, Mayfair Legal Funding recognizes the urgency of these cases and works to provide clients with timely and hassle-free funding options to cover their medical costs, legal fees, and other associated costs. Mayfair is dedicated to helping people get through tough times by offering a trustworthy and dependable source for spinal cord injury litigation financing.

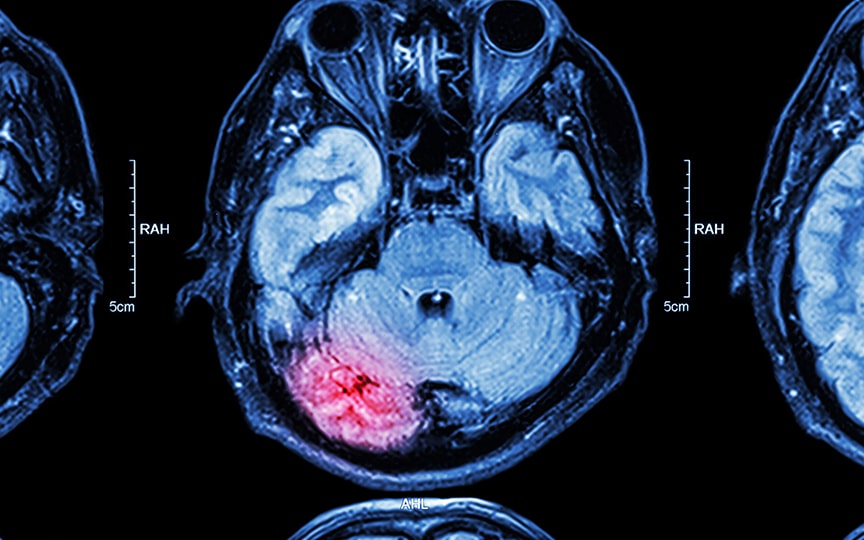

Brain Injury

People who file lawsuits for brain injuries can get financial support from Mayfair Legal Funding. Whenever the brain is damaged by a sudden, external physical attack, it incurs traumatic brain injury (TBI). It ranks among the top reasons for adult mortality and disability. TBI is an umbrella term that covers multiple kinds of brain ailments. Our team is aware of the financial stress that litigation can cause and works to lessen the load by offering pre-settlement funding to qualified plaintiffs. Mayfair Legal Funding specializes in assisting people who have had brain injuries as the outcome of accidents, negligent medical care, or other situations. They guarantee that plaintiffs have the money needed to pay healthcare costs, ongoing treatment, and everyday living expenses while awaiting a settlement by providing litigation loans.

Wrongful Death

By offering pre-settlement funds to plaintiffs, Mayfair Legal Funding hopes to lessen some of the financial stress associated with wrongful death claims, which can be both financially and emotionally taxing. Even though losing a loved one is a devastating incident, it is made more distressing when their death was brought on by the actions or negligence of someone else. Wrongful death cases may arise from medical malpractice, car accidents, workplace accidents, or defective products. Mayfair Legal Funding recognizes the critical nature of wrongful death cases and works to provide quick cash to assist plaintiffs in taking care of their immediate costs, including medical bills, funeral costs, and daily living expenses.

Mass Tort

Mayfair Legal Funding provides financial support to anyone involved in mass tort claims due to our knowledge and dedication to assisting plaintiffs. Numerous plaintiffs who have experienced similar damages or losses brought on by a common defendant or product are included in mass tort proceedings. Pre-settlement funding is offered by Mayfair Legal Funding so as to assist plaintiffs in meeting their financial obligations during these difficult legal conflicts. Mayfair Legal Funding wants to level the playing field for plaintiffs by providing mass tort litigation loans, ensuring they have the resources they need to prosecute their cases successfully.

Commercial Litigation

To help with the expenses of commercial litigation, Mayfair Legal Funding provides vital financial assistance. For people and businesses seeking justice through litigation, litigation funding has become a crucial resource. Businesses can acquire the money they need to prosecute their legal claims while maintaining their financial stability by working with Mayfair Legal Funding. Our team of professionals works directly with clients, assessing each situation individually and creating financial solutions that are tailored to fulfill particular needs. Mayfair Legal Funding is committed to assisting businesses to successfully navigate the legal system with our knowledge and dedication.

Employment

People typically experience mental and financial strain when dealing with a work-related issue, particularly when it involves wrongful termination or workplace discrimination. Employment legal financing might be very beneficial in these difficult times. Mayfair Legal Funding seeks to close the financial gap by offering quick cash advances and has a thorough awareness of the difficulties plaintiffs in these instances encounter. Plaintiffs who choose Mayfair Legal Funding have access to the funds required to pay for court costs, daily living expenses, and other financial obligations throughout the course of their employment litigation.

Worker’s Comp

If you have been hurt at work and are pursuing legal action, Mayfair Legal Funding offers workplace injury lawsuit loans. In the busy workplace of today, injuries from work have become a big problem. Accidents can occur at any job, regardless of industry or profession. Along with the critically injured worker, workplace accidents have an impact on the productivity and overall health of the business.

If you are involved in a dispute over a workplace accident, your lawsuit against your employer could be lengthy. Mayfair strives to lessen some of the financial stress placed on plaintiffs during the court process by offering lawsuit loans. Mayfair Legal Funding makes sure that people have access to the money they need to pay for living expenses, medical expenditures, and other financial commitments while their case is pending by offering a straightforward application process and quick approval periods.

Labor Law

About Labor Law

To protect employees’ rights and interests at work, labor legislation is important. It covers regulations for wages, working conditions, harassment, and other issues. If employers are suspected to have violated labor laws, workers have the legal entitlement to sue them. Mayfair Legal Funding is aware of the financial strains that protracted labor law disputes including job discrimination or salary disputes can cause. Pre-settlement funds are something that is provided to help plaintiffs in these circumstances. These funds ought to cover various expenses, like living costs, healthcare bills, legal fees, and other debts.

Jones Act

To help marine workers who have brought legal claims under the Jones Act, Mayfair Legal Funding provides loans for Jones Act lawsuits. Federal legislation known as the Jones Act gives protection to seafarers hurt while working and gives them the right to compensation from their employers. But legal proceedings can go on for a time, and plaintiffs frequently struggle financially while they wait for compensation. The void is filled by Mayfair Legal Funding, which offers litigation loans that offer quick financial assistance. They guarantee that plaintiffs only pay back the money if they prevail in their lawsuit by providing non-recourse financing. Through this arrangement, the client’s financial burden is lessened, allowing them to concentrate on their healing and asserting their legal rights.

FELA

FELA litigation loans are one of the services that Mayfair Legal Funding specializes in offering. Legislation known as FELA, or Federal Employers’ Liability Act, safeguards railroad workers who sustain workplace injuries. Mayfair Legal Funding is aware of the financial hardship plaintiffs experience while awaiting the resolution of their FELA claims. They provide FELA litigation loans to plaintiffs to help them with immediate financial needs such as living expenses, medical expenses, and other debts in an attempt to lessen this load.

Justice

WrongfuI Imprisonment

We at Mayfair Legal Funding are aware of the struggles faced by people who are wrongfully imprisoned. Being wrongfully imprisoned is a tragic experience that flips a person’s entire life upside down. Innocent persons who are wrongly imprisoned suffer losing their freedom and undergo physical, emotional, and financial hardships. Our litigation loans are made to lessen financial constraints so you may concentrate on pursuing justice. With the goal to meet your unique needs, Mayfair Legal Funding is dedicated to offering swift and hassle-free funding alternatives.

Police Brutality

Mayfair Legal Funding provides lawsuit funding services and focuses on giving clients who are suing the authorities for policing abuse financial support. At times, “police brutality” has been used to describe numerous police human rights violations. This may entail arbitrary executions, torture, or the use of riot control agents without due process when protests are taking place. Mayfair Legal Funding will assist you in securing a police brutality lawsuit loan to help support your costs during the litigation process if you are a victim of police misconduct and are pursuing a lawsuit. The funds can also be utilized to cover other necessary costs, like one’s daily living expenses and medical care.

Understanding Lawsuit Loans

Plaintiffs can receive money through legal funding, also called litigation or pre-settlement funding, before their lawsuit is resolved. Mayfair offers financial support based on the anticipated settlement’s projected value after discussing it with your attorney. It’s essential to remember that an attorney must represent you when you apply for funding. For plaintiffs experiencing financial difficulties during the legal procedure, this funding may be crucial.

Advantages and Disadvantages

Since there are still inadequate regulations in place to safeguard borrowers, legal funding or lawsuit loans are still not common financial ventures. Legal funding companies assert that they bear the risk, not the borrowers, but there are still various disadvantages to take into account.

Advantages of Legal Funding

- Immediate financial relief: Bills and expenses mount quickly, and stress may cause you to make mistakes you’ll later regret if you don’t have savings or a reliable source of income. While they wait for a just settlement, plaintiffs can take care of their financial necessities through legal funding.

- More time to negotiate a better settlement: Insurance providers will keep making you offers of compensation that are below what you are entitled to. Additionally, they would prolong the court case to put pressure on you to settle. This won’t occur, thankfully, if you have the means to cover your claim and take care of your loved ones while you await your fair settlement.

- Non-recourse structure: Legal funding is a type of non-recourse financing, in contrast to conventional loans. That implies that the maximum amount of return we can accept is the agreed-upon sum of your ultimate settlement.

Post-Settlement Funding

Post-settlement funding is an additional form of financing. This is a sort of funding made available to those who have previously been granted a settlement but are awaiting the processing of their settlement check.

This sort of funding is offered to those whose lawsuits have been settled—they have been granted a settlement but have not yet gotten their money—unlike a pre-settlement loan, where a person obtains a cash advance whilst their legal action continues underway.

Legal funding is a safer alternative than a cash advance. Furthermore, it has:

- No bearing on your finances

- Doesn’t demand a credit or job history check; and

- A non-recourse loan that is more beneficial to those borrowing

Non-recourse implies the fact that the lender is only permitted to demand the loan’s attached collateral from the borrower.

Disadvantages of Legal Funding

- Not every situation is eligible for legal funding: A legitimate funding company assumes the risks. Therefore, only lawsuits with strong grounds are likely to be granted a lawsuit loan. Even though it just takes a few hours, applicants for personal injury claims may still need to submit many applications before receiving approval.

- It might be costly: Lawsuit loans are pricey, and if you neglect to choose the one with the lowest interest rate, you can end up paying twice as much as you borrowed. Personal injury cases sometimes take longer to resolve. Interest tends to compound every month. You ought to pay hundreds of dollars in interest if your lawsuit drags on for years.

- It is not governed: Traditional loans are governed by laws. Federal governments have legislation in place to safeguard both borrowers’ and lenders’ interests. Loans for legal cases, however, are unique. Since legal funding is non-recourse, lenders contend that it differs from regular loans. If the plaintiffs lose their case, they are not required to repay the funds that they acquired.

Additionally, it is unnecessary to make projections about a prospective settlement amount when using post-settlement funding. Instead, you receive a sum based on the settlement sum you anticipate receiving in accordance with the agreed value in dollars.

It is important to note, however, that even though this type of funding exists, Mayfair does not offer this type of funding.